Shifting Times Require Modifying Methods: Chapter 3 of 3

This week we wrap up our little mini-series in our discussion of risk and its impact on how we invest. Here are the links to the two previous posts, if you want to review them:

Because You Asked: How Do You Respond to Changing Times? Chapter One

Because You Asked: How Do You Respond to Changing Times- Part 2 of 3

Typically, our investment decisions and recommendations lie between the boundaries of what has been referred to as “guaranteed and/or risk-free” investments against the other end of the spectrum, such as the more high-risk type, which involves individual stock selections. You may recall that selecting individual stocks increases the amount of risk in portfolios. Most investors understand and accept the concept that a judiciously increased amount of risk enables one to achieve a better return on their investments, which is also known as an equity risk premium.

But our current economic and financial conditions have had a fairly dramatic impact upon the options available for those who generally do not want to incur much risk as compared to more moderately risk-tolerant investors. Previously we used these lower-risk investments to alleviate some of the risks that an investor takes. We briefly discussed in our last post the long-held approach to a diversified portfolio known as a 60-40 allocation: an investor has a portfolio that invests 60% in stocks or equities (which can be comprised of individual stocks, ETF’s or mutual funds), and 40% in bonds, which can include Treasury bills. But now? How can we recommend an investment that will pretty much guarantee a negative return, such as the case with Treasury bills as discussed last week?

This is an issue that has risen to the top of our concerns in investment selection and allocation and has caused us to re-think this approach, as it seems to be doing for many advisers. One recent article on this subject was titled: Welcome to the Death Throes of 60:40 Diversification; a pretty dramatic title, but it captures the sentiment. There is actually a sort of two-sided risk when it comes to these “safe” bonds and treasuries, which is a little difficult to explain, but we will try.

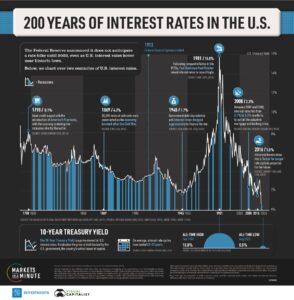

This chart from New York Life Investments Markets in a Minute displays a history of interest rates in the US: https://advisor.cusualcapitalist.com/us-interest-rates

Bonds appreciated in value beginning in 1981 because the yield of bonds was gradually decreasing in the years since. But now we have reached the bottom – zero or very close to it, so there is no place to go to achieve any return. We are stuck as it were. And as you may realize from the box on this graphic that quotes the Federal Reserve Chairman, they do not anticipate increasing rates until 2023.

What does this mean for investors?

Unless investors are willing to accept these “next to nothing” yields, which will result in an overall decrease in value, by the time we factor in rising inflation of between 1 and 2% and growing, we must seek out alternatives. We think that in one sense, investors are going to have to revisit, and we will revisit with them, their current thinking and feelings around this concept of risk. Some may need to broaden or lengthen their perspectives and time horizons and examine long-term goals in light of our current limitations. While we do not want to advise clients to accept more risk than what is tolerable for them, it may mean that we simply clarify the ramifications and risks involved in what was previously perceived as “low risk” investments.

These current excruciatingly low-interest rates are going to continue for some time, so if clients are truly risk-averse, the question arises as to whether they should be investing at all, or should just accept the less than 1% return being offered. That may be a decision that some will need to make. For others that determine that they are willing to accept a bit more volatility, we may instead focus on assets that will pay them a higher and increasing dividend. This will allow them to realize some returns or little paychecks along the way to meet and typically exceed inflation.

Regardless, we know that these concepts and feelings around “risk” are ever more important both for current and future investment considerations, and it is a topic that we will be carefully reviewing in our client conversations.